A new study shows Salford property sales have had the biggest drop since 2008, despite annual income improvements.

The analysis of ONS data from 2003-2023 shows Salford had one of the largest disparities between house price increase and income percentage change, suggesting residents in the area are less likely to be able to afford housing whilst maintaining a good quality of life.

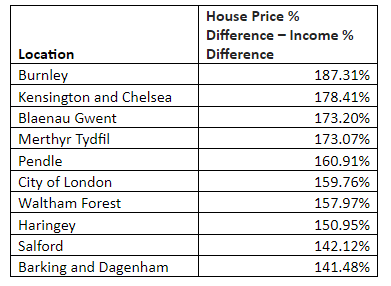

This graph shows the percentage change of property sales, house prices and annual income in Salford year on year, over the past 20 years:

The largest disparity between house price percentage change and income percentage change can be seen in 2020-21, perhaps unsurprisingly, as a result of a drop in employment during the pandemic and an increased demand for houses, ultimately pushing the two factors apart.

This larger disparity could also be due to the government introducing a Stamp Duty holiday in July 2020, which temporarily increased the tax threshold for residential properties, effectively reducing the tax burden for buyers and stimulating market activity.

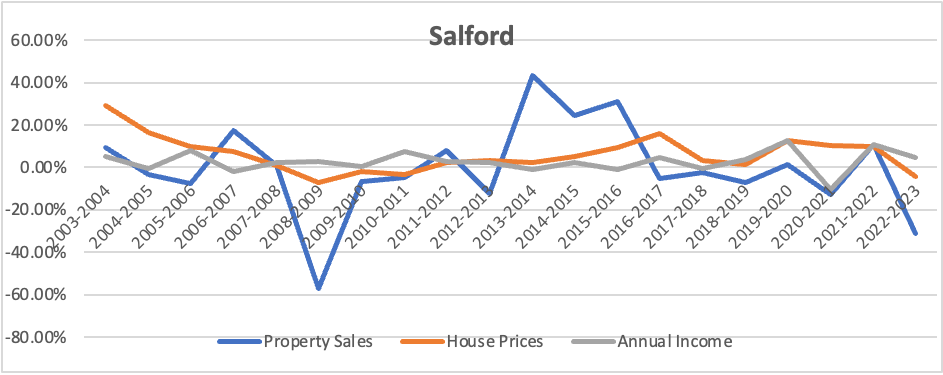

To get a sense of affordability across all locations in the UK, researchers at Bird & Co worked out the percentage change in house prices from September 2003 to September 2023, and the same for income from March 2003 to March 2023, and found the difference between these figures. From this, the areas with the largest disparity between house price and income growth became apparent.

Daniel Chard, Partner at Bird & Co, said: “The findings reveal Salford as one of the least affordable places to buy a home in the UK, which could be discouraging news for prospective buyers in the region.

“This study should inspire those looking to buy a home to consider the long-term relationship between income and house prices to better understand affordability.

“However, it’s evident that factors beyond affordability are holding people back from becoming homeowners. Even when house prices and incomes align closely, property sales remain somewhat unaffected.

“This could indicate a lack of suitable housing availability, property value fluctuations, current interest rates, and mortgage availability.

“Personal circumstances, such as job security and long-term financial planning, also play a significant role. We urge anyone looking to buy a home to consider these long-term factors to ensure a better quality of life after purchasing a home.”

Alongside Salford, the 10 locations with the largest disparity, and therefore where wage growth is not keeping pace with house prices, were:

The results show a variety of locations across England and Wales that appear to have low affordability.

The only area to present a unique case with a negative disparity was Ribble Valley in Lancashire, suggesting that wages have grown faster than house prices. This rare scenario can indicate an exceptionally affordable housing market, potentially attracting new residents and investment.

A number of ‘affordable’ housing plans have been approved by the council this year and the Mayor of Salford has previously pledged to build more council homes in the city.

The Mayor Paul Dennett pledged to build hundreds of new council homes over the next four years in March (2024). He made the promise for the “desperately needed” homes to fight a “crisis” of housing and homelessness in the city.